China Shipping Delays to Australia

China: Demand from large retail and lifestyle customers is fuelling a likely 10% increase in trucking demand in Q4.

The usual capacity crunch due to the Christmas volume peak looks as though it could be further impacted from pandemic controls across China. Thus, as we expect China shipping delays, we encourage our customers to plan shipments earlier than previous years and provide rolling demand forecasts for trucking, rail and barges so shipping companies can allocate equipment and capacity accordingly.

We anticipate Intercontinental rail demand will be much stronger in Q4 compared with last year but neither capacity nor equipment availability has significantly improved. ICR is also suffering from chassis shortages, border congestion and loading restrictions which are seriously impacting reliability. Customers should be prepared for long transit times from China to Australia and plan as early as possible.

CHINA FACTORIES

Electricity shortages caused by supply constraints, toughening regulatory settings and strong demand are causing some economic stress across many parts of China. Shortages could become a drag on production growth.

![]() Factory output is being affected by power shortages in at least 10 Chinese provinces. This includes Guangdong, Anhui, Zhejiang and Jiangsu. Several publicly traded companies have disclosed production halts. This has affected a broad range of manufacturing plants and heavy industry such as aluminium and Steel smelters.

Factory output is being affected by power shortages in at least 10 Chinese provinces. This includes Guangdong, Anhui, Zhejiang and Jiangsu. Several publicly traded companies have disclosed production halts. This has affected a broad range of manufacturing plants and heavy industry such as aluminium and Steel smelters.

CHINA PORTS

China and Global ports are growing more gridlocked as the pandemic era’s supply shocks intensify, threatening to spoil the holiday shopping season, erode corporate profits and drive up consumer prices.

![]() Bloomberg’s Port Congestion Tracker shows a typhoon in Asia spawned another wild week for shipping in a year with multiple challenges — a vessel wedged in the Suez Canal, a dozen major storms, rolling Covid lockdowns disrupting key manufacturing hubs in China, a shortage of truckers and dockworkers, and a resurgence of consumer demand.

Bloomberg’s Port Congestion Tracker shows a typhoon in Asia spawned another wild week for shipping in a year with multiple challenges — a vessel wedged in the Suez Canal, a dozen major storms, rolling Covid lockdowns disrupting key manufacturing hubs in China, a shortage of truckers and dockworkers, and a resurgence of consumer demand.

![]() As of Friday, at least 107 container ships were waiting off Hong Kong and Shenzou. The pileup worsened when the storm brushed past Hong Kong around midweek, shutting down its stock exchange and idling its ports. Globally, RBC Capital Markets reckons 77% of ports in China are experiencing abnormally long times to turnaround traffic.

As of Friday, at least 107 container ships were waiting off Hong Kong and Shenzou. The pileup worsened when the storm brushed past Hong Kong around midweek, shutting down its stock exchange and idling its ports. Globally, RBC Capital Markets reckons 77% of ports in China are experiencing abnormally long times to turnaround traffic.

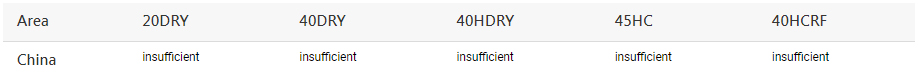

CONTAINER AVAILABILITY

Australia and New Zealand: Lack of capacity from China to Australia and New Zealand continues to put pressure on costs and transit times. Export cargo bookings from Australia to New Zealand remain under ad hoc terms for both capacity and rates due to very limited carrier options.

VIETNAMESE EXPORTS NOTES – OUR FACTORIES

Vietnamese Exports Factories at the start of October are back at full Capacity with normal staff and production rates are back to normal as Vietnam is relaxing COVID restrictions, with no Xmas break its a good time for Australian Companies to meet productions schedules during this difficult time.

Vietnamese Exports, being in partnership with their Vietnamese factories, can immediately start projects once we have full Shop drawings. With our Australian Standard procedures and testing already in place we can keep all projects on Schedule

SHIPPING by VIETNAMESE EXPORTS

Our shipping from Vietnam is still consistent 12 -24 days to Australia , its very hard to control especially at Transit Ports. Vietnamese Exports have an experienced Local Vietnamese Shipping Company who controls from booking Containers, pick up from Factory, Vietnam Customs to arrival at the Australian Port handling any problems that arise and believe me every Container has problems.

Without experience or Control your shipment could have long delays Ordering/ Shipping from China without any Fabrication control and long Shipping times and many delays is at a very high level of risk to any Australian Company.

Contact our team at Vietnamese Exports to learn more how we can make all Steel Projects successful for your Company